Ph payroll calculator

Our Excel payroll software template is a simple monthly payroll solution for businesses with less than 50 employees and includes sufficient flexibility to be an. The application is simply an automated computation of the withholding tax due based only on the information entered into by the user in the applicable boxes.

Payroll Calculator Free Employee Payroll Template For Excel

The Monthly Wage Calculator is updated with the latest income tax rates in Philippines for 2022 and is a great calculator for working out your income tax and salary after tax based on a.

. We hope these calculators are useful to you. Using Payroll Calculator firms can offer assistance in considering the unmistakable taxes that should be paid each quarter by your association. The compensation income tax system in The Philippines is a progressive tax system.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates.

From the Philippines leading Payroll Provider JeonSoft Corporation comes with PayrollPH - a fast modern and flexible payroll system youll surely fall in love with. Enter up to six different hourly rates to estimate after-tax wages for hourly employees. Calculate public holiday pay Calculate public holiday pay Use this calculator to find out your pay for working on a public holiday falling on a working day or non-working day.

Oklahoma payroll tax calculator can engage. Salary Calculator The quickest way to get your take-home pay Understand what youve been offered. Language Visual Basic PayCalocx is a simple payroll component.

Insert your salary to discover your take home pay. Accordingly the withholding tax. Payroll HRIS System.

For example if an employee earns 1500 per week the individuals annual. Plug in the amount of money youd like to take home. So what are you waiting for.

When you choose SurePayroll to handle your small business payroll. It will confirm the deductions you include on your. Statutory contributions such as.

Salary Breakdown Monthly PHP. Get your subscriptions now. Figures shown by the calculator are based on the tax reforms tax schedule for 2017 2018 and 2019 including deductible exemptions and contributions.

Taxable Income Monthly Salary - Total Deductions 25000 - 1600 23400 Base on our sample computation if you are earning 25000month your taxable income would be. Payroll Processing is now as simple flexible and accessible anywhere with Cloud Hosting Environment. If payroll is too time consuming for you to handle were here to help you out.

Philippines Payroll Calculator Submitted by nostradamus1566 on Friday June 12 2015 - 2329. Book A Demo. Sweldong Pinoy Sweldong Pinoy is a salary calculator for Filipinos in computing net pay withholding taxes and contributions to SSSGSIS PhilHealth and PAG-IBIG.

Ang tax calculator na ito ay pawang para sa mga sumasahod lamang dahil sa ibang sistema ng pababayad ng buwis para sa mga self-employed at propesyunal tulad ng mga doktor.

How To Do Payroll In Excel In 7 Steps Free Template

Payroll Template Free Employee Payroll Template For Excel

13th Month Pay Calculator Taxable Amounts How To Compute

How To Compute Back Pay In The Philippines With Free Calculator Filipiknow

Payroll Calculator Free Employee Payroll Template For Excel

Tax Calculator Philippines 2022

How To Do Payroll In Excel In 7 Steps Free Template

How To Do Payroll In Excel In 7 Steps Free Template

15 Free Payroll Templates Smartsheet

Salary Formula Calculate Salary Calculator Excel Template

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Calculator Free Employee Payroll Template For Excel

Free Download Payroll System Using Excel Sheets Template 2020 Axeetech

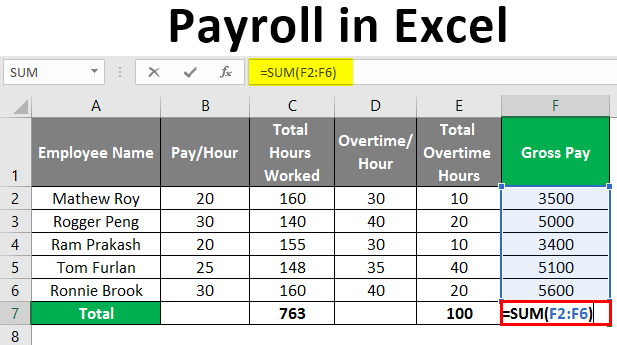

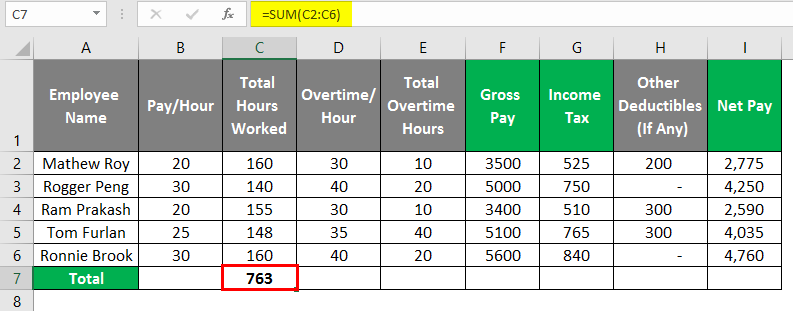

Payroll In Excel How To Create Payroll In Excel With Steps

Payroll In Excel How To Create Payroll In Excel With Steps

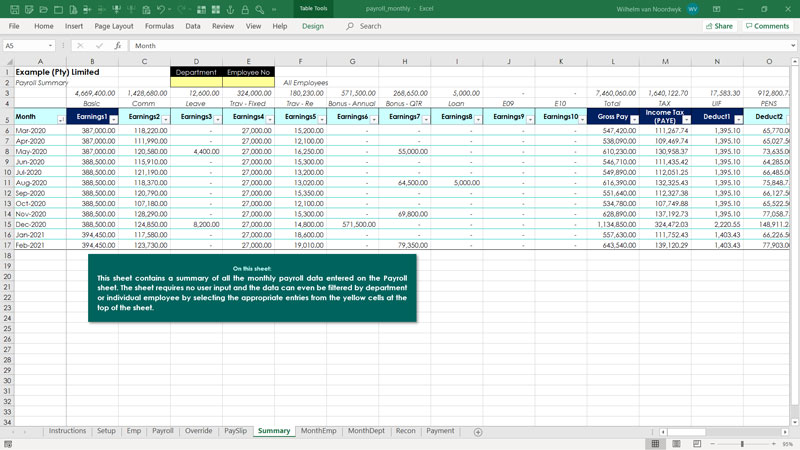

Excel Payroll Software Template Excel Skills

Excel Formula Basic Overtime Calculation Formula